You already know Black Friday is huge, but do you know how huge?

95% of consumers worldwide recognize Black Friday. That’s nearly the entire planet tuning in for the biggest sales frenzy of the year.

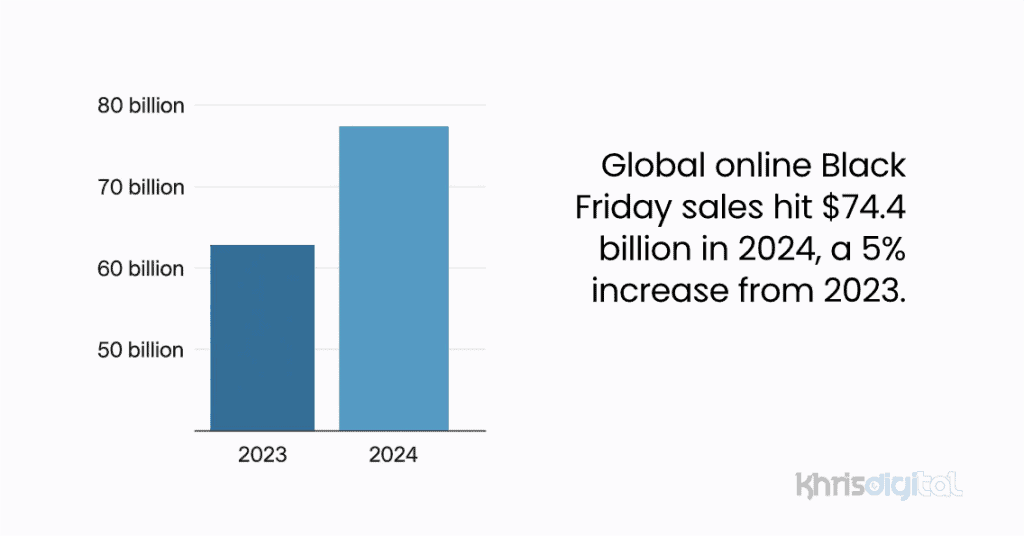

And in 2024? Global online sales on that single day hit a staggering $74.4 billion, up 5% from 2023.

Wild, right?

This post breaks down eye-opening Black Friday statistics that show just how far the shopping madness goes, from spending habits and online trends to what shoppers really want and how businesses are cashing in.

Every number here comes from verified, reputable sources, and you’ll find them all listed at the bottom.

Let’s get into it.

🔑 Key Black Friday Statistics:

Next, before we get started, lets analyze how black friday has changed over the years:

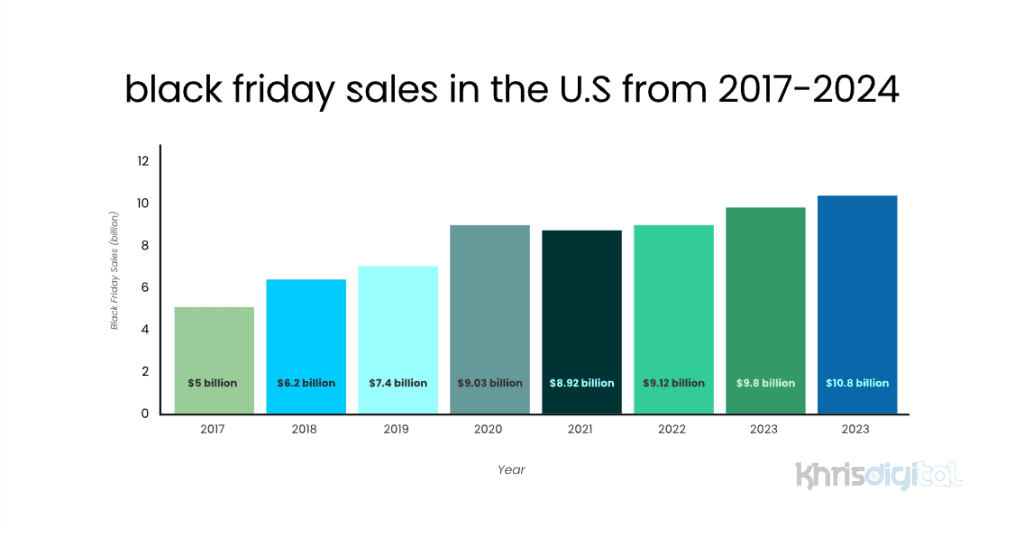

Black Friday statistics by year in the U.S.

| Years | Total Online Sales |

|---|---|

| 2024 | $10.8 billion |

| 2023 | $9.8 billion |

| 2022 | $9.12 billion |

| 2021 | $8.92 billion |

| 2020 | $9.03 billion |

| 2019 | $7.4 billion |

| 2018 | $6.2 billion |

| 2017 | $5 billion |

1. 95% of consumers worldwide know about Black Friday.

(BCG)

If you think Black Friday is just a U.S. thing, think again. You’re part of a global phenomenon.

It’s the moment brands gear up for, and shoppers save for. Whether you’re hunting for deals or planning promotions, this level of awareness means you’re tapping into a worldwide wave of buying energy.

2. Global online Black Friday sales hit $74.4 billion in 2024, a 5% increase from 2023.

(Tech Crunch)

In 2024, sales jumped 5% from the year before, pushing the total to a jaw-dropping $74.4 billion. That’s proof that more people are shopping online, and they’re spending more when they do.

For you, this means two things: the competition for digital attention is fiercer than ever, and the window to convert is tighter.

Whether you’re selling products or planning purchases, this stat tells you that Black Friday is still growing, and the race starts earlier every year.

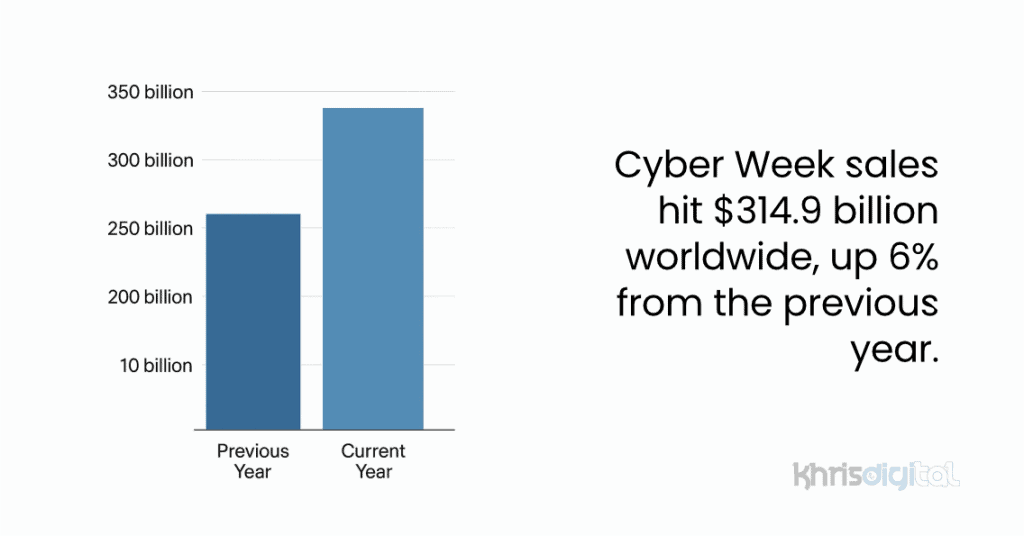

3. Cyber Week sales hit $314.9 billion worldwide, up 6% from the previous year.

(SalesForce)

That 6% jump shows you that what shoppers do during Cyber Week (from Thanksgiving through Cyber Monday) is becoming ever more powerful.

For you, this means discounts are triggering purchase surges, mobile shopping is dominating, and tech like AI is pushing engagement by personalizing offers and support.

If you want to succeed in the digital commerce game, make sure you nail your Cyber Week strategy, optimize early, lean into mobile, and consider personalization tech.

4. Thanksgiving online sales reached $33.6 billion globally, up 6% year‑over‑year.

(Tech Crunch)

That 6% growth tells you that people are shopping earlier and more confidently. This is driven by strong mobile use, and nearly 60% of those sales came from phones.

What this means for you, if you’re a retailer, is that launching your biggest discounts before Black Friday is no longer optional. And if you’re a shopper, you’re not waiting for Friday as deals are going live earlier.

5. U.S. online Black Friday sales hit $10.8 billion, a 10.2% rise from last year.

(Adobe)

Growing from $9.8B to $10.8B means American shoppers pushed online spending to a new high. That 10.2% increase shows you that despite inflation and mixed economic signals, consumers still believe in Black Friday deals, enough to click “buy” in bigger numbers.

If you sell online, this means your site needs to perform flawlessly under pressure (think mobile checkout, fast load times, strong deals).

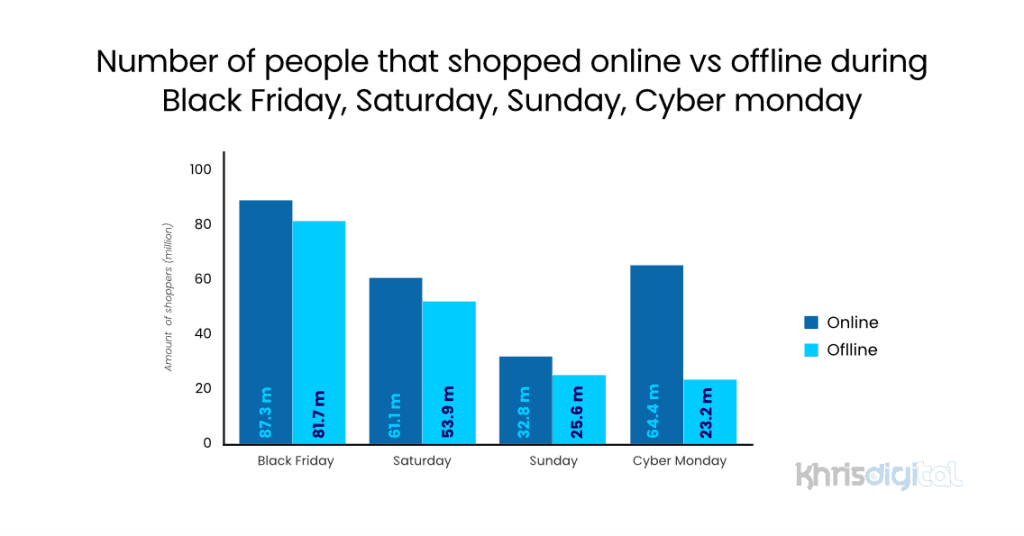

6. 87.3 million shopped online vs. 81.7 million in stores on Black Friday.

(Demand Sage)

The gap may seem small, but it shows a major shift in shopping behavior. Convenience, early access to deals, and mobile-first experiences continue to tip the scale toward digital.

Still, the strong in-store turnout proves physical retail hasn’t lost its appeal, especially for shoppers chasing last-minute deals or craving that holiday rush.

7. Saturday flipped the usual pattern: 61.1 million shopped in stores vs. 53.9 million online.

(Demand Sage)

After the online chaos of Black Friday, something surprising happened. By Saturday, the tides had turned, as 61.1 million people chose to shop in person, while 53.9 million opted for online deals.

You’d think the digital momentum would keep climbing, but no, people still craved the in-store hunt.

It could be the instant gratification, or the deals looked better when you could touch them. Whatever the reason, Saturday reminded everyone that physical retail still has serious pull.

8. On Sunday, 32.8 million shopped online while 25.6 million went in-store.

(Demand Sage)

Sunday wasn’t exactly quiet, but it was calmer. It was the pause before Cyber Monday’s storm.

A day for second thoughts, deal hunting, or snatching up the things that didn’t sell out. The numbers indicate that while the urgency decreased, the desire to shop remained unchanged.

9. Cyber Monday drew 64.4 million online shoppers, but only 23.2 million went in-store.

(Demand Sage)

Cyber Monday kept its digital crown, but in-store traffic was the lowest of the entire weekend.

That’s not surprising, though. People were back at work, back on routine, but still shopping from their phones and laptops. The low in-person turnout shows how Cyber Monday has fully cemented itself as a stay-home-and-click event.

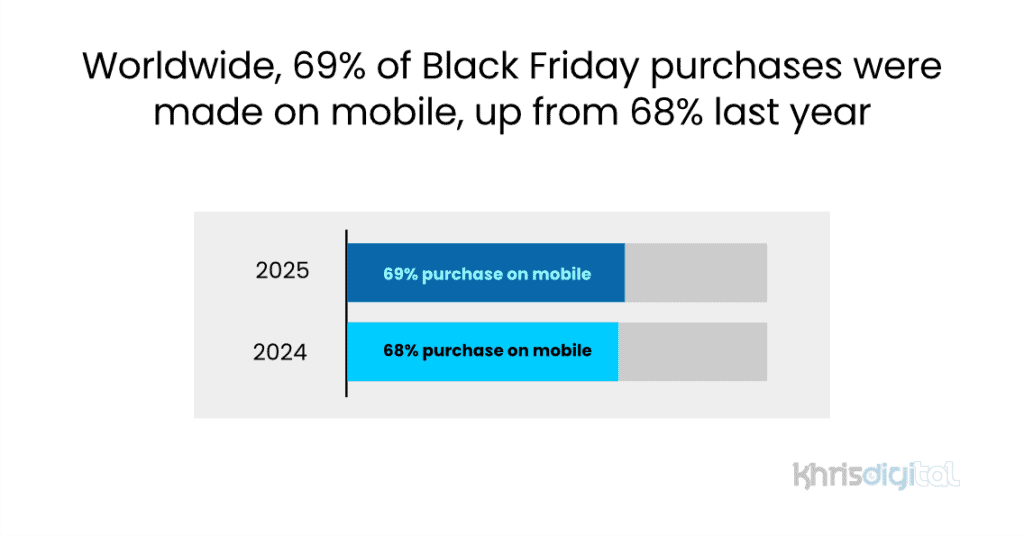

10. Worldwide, 69% of Black Friday purchases were made on mobile, up from 68% last year.

(National Retail Federation)

Phones officially took over Black Friday. This tells you that shopping is no longer a sit-down event. People are buying from the couch, the car, the office, and even while mid-scrolling on social media.

Brands that made mobile checkouts fast and frictionless won big. Those that didn’t? Left carts abandoned.

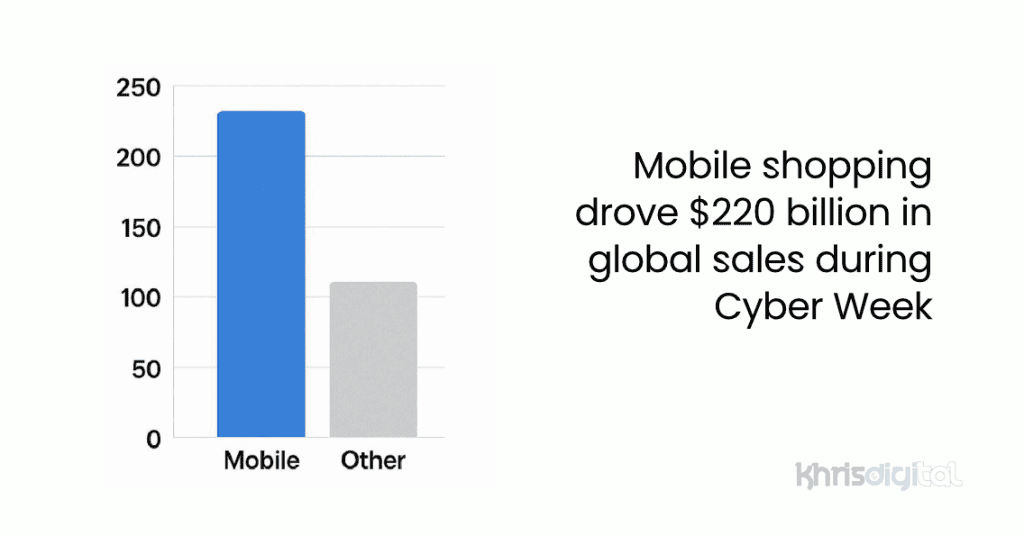

11. Mobile shopping drove $220 billion in global sales during Cyber Week.

(Salesforce)

That’s real money, flowing straight through phones. This mobile shift isn’t about convenience anymore. It’s about trust. Shoppers now feel comfortable buying big-ticket items directly from their phones, without needing a desktop.

Retailers who nailed their mobile experience? They cashed in. Those with clunky sites or laggy checkouts? Left money on the table.

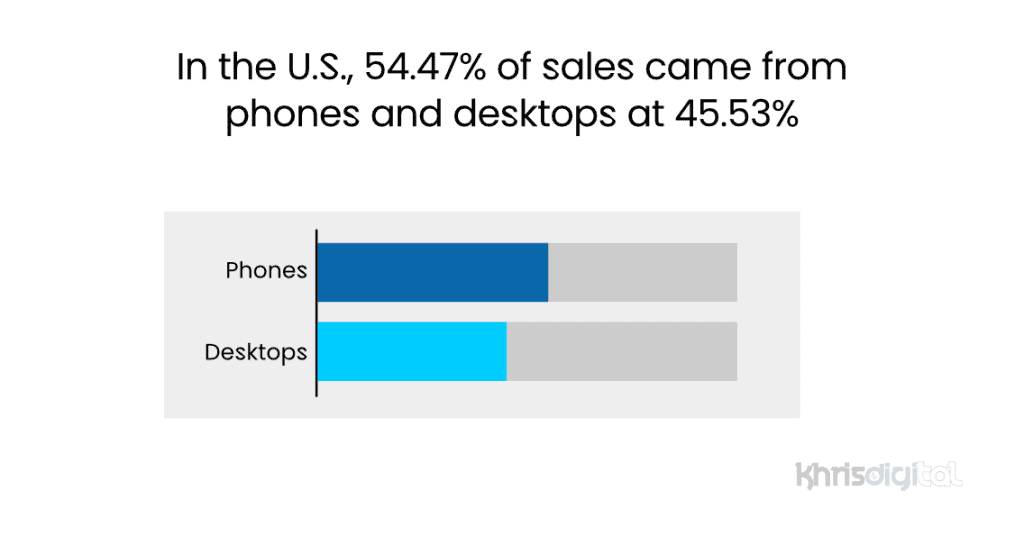

12. In the U.S., 54.47% of sales came from phones and desktops at 45.53%.

(Demand Sage)

For the first time in years, phones officially surpassed laptops in terms of shopping power. It’s proof that shopping has become a background activity, squeezed in between texts, while waiting in line, or during lunch breaks.

Shoppers are no longer clearing time to “go shop.” They’re doing it wherever they are, whenever the deal hits.

And the fact that more than half of the purchases happened on phones? That’s the new normal.

13. Thanksgiving online spending in the U.S. jumped 8.8% to $6.1 billion.

(Adobe)

You might’ve been stuffing your face, but millions were also stuffing their carts.

The significant increase from last year says a lot. People aren’t waiting for Black Friday anymore, they’re locking in deals earlier, especially while lounging at home. Retailers know this, too, which is why sales now start before dessert is even served.

14. U.S. Veterans’ Day 2024 sales hit $3.3 billion, up 6.5% from last year.

(Adobe)

Even before the big shopping holidays kicked in, Veterans’ Day pulled in $3.3 billion online, a 6.5% jump from 2023. Shoppers aren’t just circling Black Friday anymore; they’re jumping on earlier sales when the price is right.

Retailers are catching on fast, turning holidays like Veterans’ Day into warm-ups for Cyber Week.

15. U.S. Thanksgiving Eve sales reached $4.1 billion, up 5.1% year-over-year.

(Adobe)

Thanksgiving Eve used to be all about prepping turkeys and travel, now it’s also about clicking “buy.”

Shoppers are moving earlier and earlier into the holiday calendar. By the time Black Friday rolls around, many have already snagged deals. Retailers know this, too, which is why big discounts are rolling out before the turkey even hits the oven.

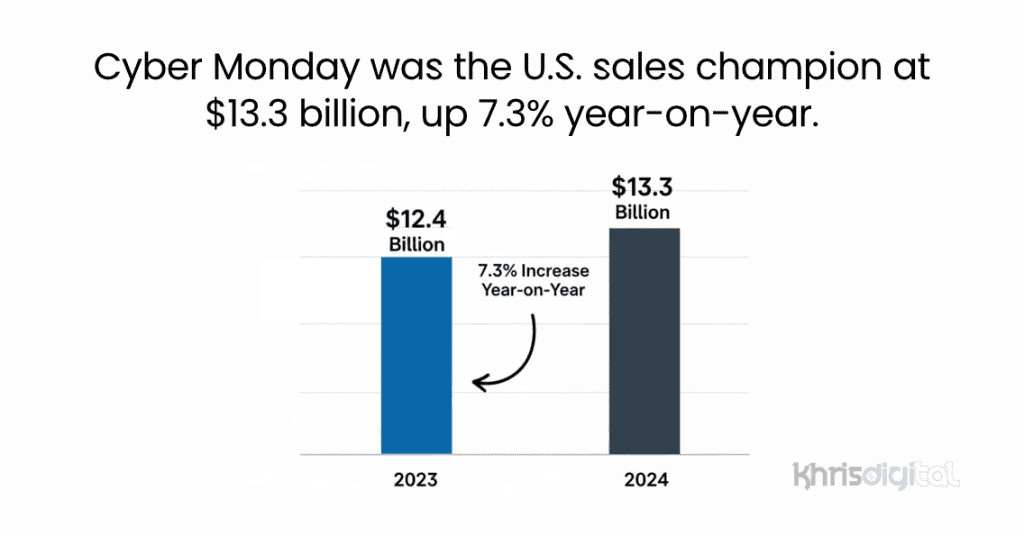

16. Cyber Monday was the U.S. sales champion at $13.3 billion, up 7.3% year-on-year.

(CNN)

No surprise here, Cyber Monday kept its crown.

The surge proves that even with sales starting earlier in November, Cyber Monday still owns the spotlight. The mix of urgency, limited-time offers, and heavy online focus makes it the ultimate deal day, year after year.

17. U.S. Cyber Week sales totaled a staggering $41.1 billion.

(CNN)

That total shows just how much shopping power is crammed into this short stretch of days. It’s not just one big sales event anymore, it’s an entire week that defines the holiday season.

And with numbers like this, it’s clear Cyber Week isn’t slowing down. If anything, it’s becoming the real kickoff to end-of-year spending.

18. On Black Friday, shoppers spent $11.3 million per minute between 10 a.m. and 2 p.m.

(Entrepreneur)

Those four hours alone added up to more than $2.7 billion in sales. That four-hour window is the heartbeat of Black Friday. It’s when deals peak, shoppers swarm online, and carts close at lightning speed.

The sheer volume highlights how compressed buying behavior has become, with billions flowing in just a few hours. For retailers, this is the make-or-break stretch where site performance, fast checkouts, and strong offers decide who wins.

19. On Cyber Monday, shoppers spent $15.8 million per minute between 8 p.m. and 10 p.m.

(USA Today)

Those two hours were a frenzy.

More than $1.9 billion changed hands in that tiny window, as millions of last-minute shoppers raced to grab deals before they disappeared. It’s the digital version of a closing-time rush, only faster and far bigger.

20. 197 million people shopped during Thanksgiving week in 2024, down slightly from 200.4 million in 2023.

(National Retail Federation)

That’s still nearly two-thirds of the U.S. population shopping in just one week, even with the small dip from last year.

The drop doesn’t mean interest is fading; it shows how the market is stabilizing after years of record highs. Shoppers are spreading purchases across earlier sales in November and waiting for specific deals rather than splurging all at once.

Thanksgiving week remains the epicenter of U.S. retail, moving hundreds of billions of dollars in a matter of days.

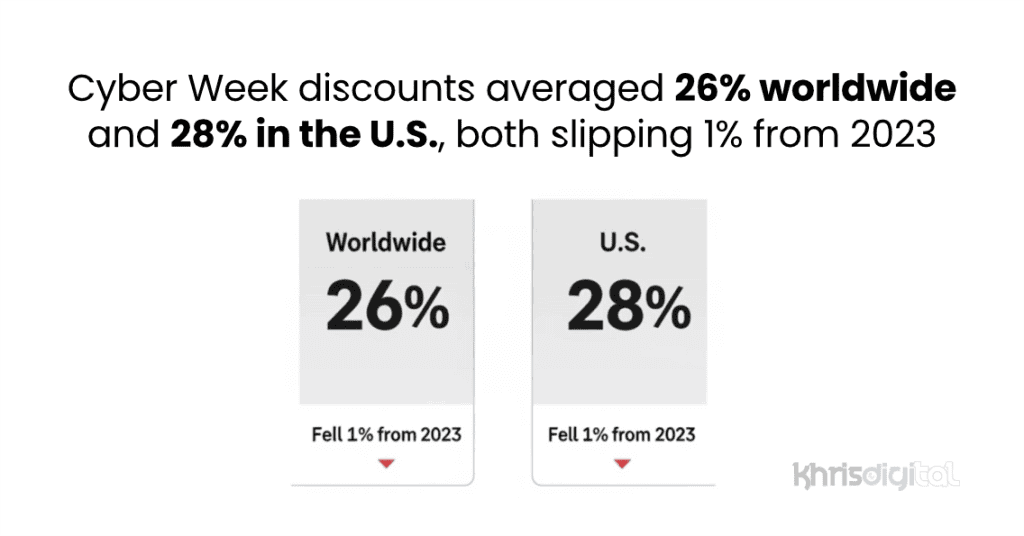

21. Cyber Week discounts averaged 26% worldwide and 28% in the U.S., both slipping 1% from 2023.

(Sender)

The bargains were still juicy in 2024, but they weren’t quite as generous as the year before. That 1% dip might look small, but at Cyber Week scale, it means billions less in markdowns.

However, shoppers still showed up in record numbers. Retailers are proving that they don’t need rock-bottom prices to drive sales. Smart promotions, limited-time offers, and early rollouts are keeping carts full even as discounts shrink.

22. “Buy Now, Pay Later” hit $686.3 million in online sales, up 8.8% from last year.

(Digital Commerce 360)

BNPL isn’t just a buzzword anymore, it’s becoming a go-to way to shop. The rise indicates that shoppers are stretching their budgets without slowing their spending.

For retailers, it’s a win too, as offering flexible payment plans keeps carts from being abandoned. As prices rise and consumers seek deals, BNPL is becoming a core part of the holiday shopping toolkit.

23. U.S. online sales jumped 14.6%, while in-store sales barely rose 0.7%.

(MasterCard)

Talk about a tale of two worlds. It’s a clear signal of where momentum is headed. Screens are stealing the show.

The gap highlights how consumers are prioritizing speed, convenience, and digital deals over crowded aisles. Stores aren’t disappearing, but they’re no longer driving the growth story.

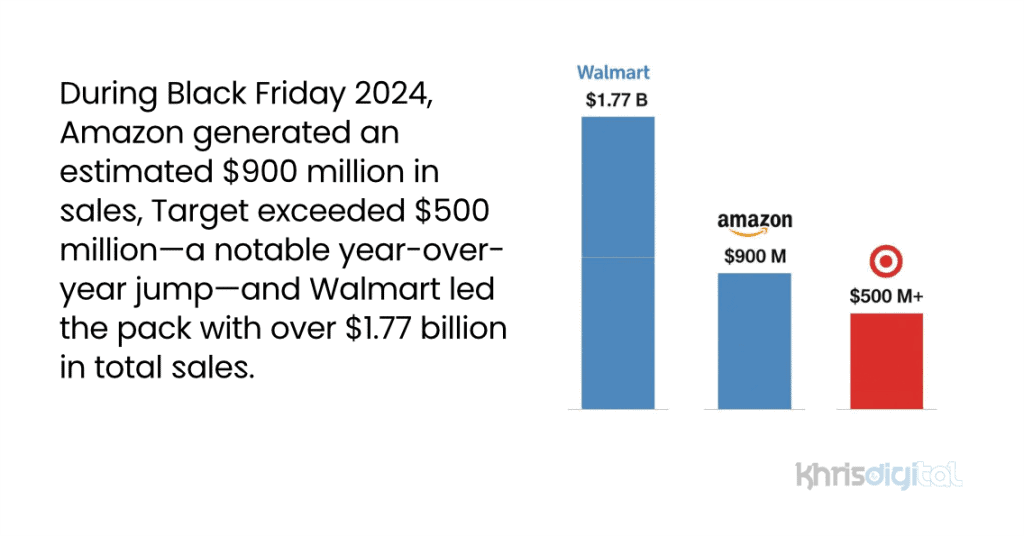

24. Amazon’s Black Friday 2024 sales topped $900 million.

(Facteus)

That’s a serious haul. What makes it striking is how much that reflects its pull: millions turning to the platform, deals flying off virtual shelves, and everything running at peak scale.

It shows Amazon’s dominance and how central it remains in the holiday spending map. Even a giant like Amazon is shaped by shoppers’ behavior: what they want, when they want it, and how quickly supply and delivery systems can keep up.

25. Target’s Black Friday 2024 sales smashed past $500 million, climbing sharply from last year.

(Facteus)

The surge reflects how its mix of early deals, strong online presence, and in-store buzz paid off big.

This is proof that well-timed promotions and brand loyalty can still push a traditional retailer into billion-dollar conversations during the busiest shopping stretch of the year.

26. Walmart’s Black Friday 2024 sales surged past $1.77 billion,

(Facteus)

Walmart came out swinging in 2024. That kind of number shows just how firmly the retailer has cemented itself as a holiday shopping powerhouse.

With aggressive discounts, doorbuster deals, and a massive online footprint, Walmart managed to capture both digital carts and in-store crowds.

It’s a reminder that even with Amazon dominating headlines, Walmart remains one of the few retailers big enough to turn Black Friday into a billion-dollar payday.

27. Online stores saw a 4.3% conversion rate on Black Friday, far above the 2.5% yearly average.

(Sender)

That jump shows how powerful urgency and discounts are in driving action.

On a typical day, shoppers hesitate, compare, or abandon their carts. But on Black Friday? Windows close fast, deals vanish in minutes, and hesitation means missing out. It’s the one day when browsing turns into buying at record speed.

28. AI and AI agents drove over $14 billion in global online sales on Black Friday.

(Shopify)

Artificial intelligence was busy making sales happen this black friday. Shoppers leaned heavily on AI chatbots and assistants to track down deals, with bot-driven clicks to retail sites skyrocketing by nearly 1,800% compared to last year.

Retailers who embraced AI saw the payoff too, reporting conversion rates up to 9% higher than those who didn’t.

It wasn’t just customer service bots either. AI worked behind the scenes, shaping personalized recommendations, adjusting prices in real-time, and nudging hesitant shoppers toward checkout.

Black Friday 2024 proved that AI isn’t just a helpful tool anymore, it’s a sales engine.

29. Clothing and accessories made up 49% of Black Friday 2024 sales, while toys claimed 31%.

(Sender)

Fashion ruled Black Friday in 2024. Nearly half of all sales went to clothing and accessories, proving once again that shoppers can’t resist a good wardrobe upgrade when the discounts hit.

Toys weren’t far behind, grabbing 31% of sales. With the holidays just around the corner, parents and gift-givers have clearly used Black Friday to get a head start on their wish lists.

Together, these two categories accounted for the bulk of the day’s spending.

30. Black Friday toy sales jumped 178% compared to an average October day.

(Demand Sage)

Black Friday turned into a toy rush in 2024. The timing makes sense, shoppers aren’t just chasing discounts, they’re also racing to lock in the hottest toys before shelves run empty.

Black Friday has become the moment when holiday wish lists meet urgency, driving toy sales to levels no ordinary shopping day can touch.

31. Cross-border sales made up 15% of global Black Friday orders.

(Sender)

This statistic shows how the event has evolved into a global marketplace, with retailers expanding their reach and consumers shopping without limits.

From U.S. gadgets shipping to Europe to fashion flowing out of Asia, cross-border buying is now a defining feature of Black Friday’s global footprint.

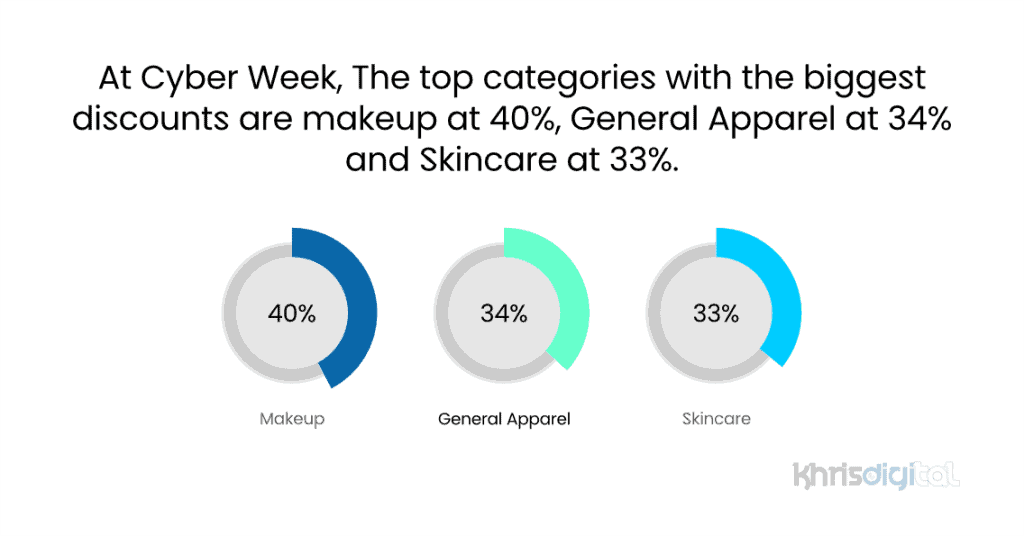

32. Average Cyber Week discounts hit 26%, with makeup leading at 40% off.

(Demand Sage)

Cyber Week was packed with deals, but not all categories played equally, as beauty lovers scored the biggest wins.

The significant cuts in cosmetics highlight how competitive the beauty market has become, with brands offering aggressive promotions to capture attention.

It also reflects how shoppers use Cyber Week not just for big-ticket items but for stocking up on everyday favorites. In many cases, beauty deals were as irresistible as electronics, proving that self-care spending has a firm spot in holiday shopping habits.

33. Makeup, apparel, and skincare topped Cyber Week discounts at 40%, 34%, and 33%.

(Sender)

These numbers reveal two key insights: first, the increasing aggressiveness of beauty brands in courting holiday shoppers, and second, the enduring importance of clothing and personal care in every shopping cart.

While tech often grabs the headlines, the steepest discounts remind us that Cyber Week is also about style and self-care.

34. Bot-driven clicks to retail sites surged 1,800% year-over-year.

(Retail Dive)

Black Friday 2024 wasn’t just powered by people, bots were in on the action too. This explosion shows how fast consumers are adopting AI helpers to scout deals, compare prices, and even make purchases.

What once felt futuristic is now mainstream: bots are reshaping how traffic flows to retail sites.

For retailers, it’s both an opportunity and a challenge. AI can drive more sales, but it also means competition for visibility is no longer just human.

35. Black Friday 2024 spending rose 4%, with average order values up 3%.

(Criteo)

That combination points to a healthy shopping season. Not only are people buying, but they’re also adding extra items to their carts.

It’s proof that despite economic pressure, Black Friday still encourages consumers to spend a little more and stretch their budgets to secure deals they don’t want to miss.

36. Retail media ads nearly doubled (+92%) and social ads rose 35% on Black Friday 2024.

(Sender)

Brands went all-in to grab shopper attention, and the ad spend proves it. Retailers weren’t just discounting, they were fighting to be seen, pouring money into the platforms where shoppers were scrolling and searching most.

The spike in ad spend also reflects the growing role of retail media networks, which are fast becoming the new battleground for visibility.

37. Shopify merchants hit $11.5 billion in sales during BFCM weekend, up 24% year-over-year.

(Shopify)

For Shopify sellers, Black Friday through Cyber Monday was nothing short of a massive success.

With shoppers looking for unique products and seamless online experiences, Shopify merchants proved they can go toe-to-toe with retail giants. This illustrates the increasing influence of independent sellers in shaping holiday shopping.

38. Shopify sales peaked at $4.6 million per minute at 12:01 p.m. EST.

(Shopify)

At lunchtime on Black Friday, Shopify reached its peak. That brief peak illustrates the intense focus of shopper activity, with thousands of transactions co-occurring.

It’s a reminder of how critical timing is. When deals are hottest and shoppers are most active, sales can skyrocket in a matter of minutes. For Shopify merchants, being ready at peak hours was the difference between riding the surge and missing it entirely.

39. The average Shopify cart value on Black Friday was $108.56 ($109.70 constant currency).

(Shopify)

Shoppers weren’t just grabbing single items, they were filling carts. This shows that consumers used the day to bundle purchases, taking advantage of discounts to stock up rather than buy one-off products.

It also shows the strength of Shopify merchants in nudging shoppers toward slightly higher basket sizes through smart upsells and holiday promotions.

40. Cross-border orders made up 16% of all Shopify sales on Black Friday.

(Shopify)

Borders didn’t confine black Friday shopping.

Shoppers are willing to look abroad for the right price, rare finds, or products not available locally, and Shopify’s network made it easier than ever to connect buyers and sellers worldwide.

41. More than 76 million consumers worldwide shopped from Shopify-powered brands.

(Shopify)

Consumers aren’t only turning to retail giants, they’re actively seeking out smaller, niche, and direct-to-consumer brands.

For Shopify merchants, it was validation that their products and promotions could compete at the highest level of the holiday season.

42. Over 16,500 entrepreneurs made their first sale on Shopify during BFCM 2024.

(Shopify)

Black Friday through Cyber Monday wasn’t just about record numbers for established brands, it was a launchpad for new ones.

That milestone shows how the holiday rush creates opportunities for fresh businesses to break into the market. For many of these new sellers, Black Friday was the moment their brand officially took off.

43. Over 67,000 merchants hit their biggest sales day ever on Shopify.

(Shopify)

Black Friday 2024 didn’t just break records at the platform level; it shattered them for individual sellers as well. That wave of success reflects how far the platform has come in empowering independent businesses.

From niche shops to scaling brands, thousands hit new milestones all at once, proving that Black Friday remains the ultimate stage for growth.

44. Shopify’s top-selling categories were Clothing Tops, Cosmetics, Fitness & Nutrition, Pants, and Activewear.

(Shopify)

The bestsellers of Black Friday on Shopify painted a clear picture of shopper priorities.

Fashion and self-care dominated carts, while the strong showing of fitness and nutrition reflected consumers’ focus on health heading into the new year.

The mix shows how Shopify merchants tapped into both style and lifestyle, two areas where shoppers were clearly willing to spend big.

45. The U.S., U.K., Australia, Canada, and Germany led Shopify’s Black Friday sales.

(Shopify)

Shopify’s global footprint was on full display during Black Friday 2024. These markets highlight where consumer demand is strongest and where Shopify merchants are gaining the most traction.

From North America to Europe and the Pacific, the platform has become a bridge connecting independent sellers to some of the world’s most active holiday shoppers.

46. Shopify’s top Black Friday cities were Los Angeles, New York, London, San Francisco, and Miami.

(Shopify)

These hubs represent some of the most trend-driven and digitally savvy shoppers, where demand for fashion, beauty, and lifestyle products fuels enormous online spending.

The spread also shows Shopify’s strength across both U.S. and international markets.

47. 62% of Americans think Black Friday discounts are just a marketing ploy.

(Sender)

Despite billions in sales, not everyone buys the hype. The skepticism reflects years of seeing inflated “original prices” slashed for show, or finding the same discounts available weeks before and after Black Friday.

Yet, even with this distrust, shoppers still turn out in droves, proving that the thrill of the hunt and fear of missing out often outweigh doubts about authenticity.

48. 84% of Gen Z planned to shop on Black Friday 2024.

(Dot Digital)

Their presence demonstrates how Black Friday has evolved beyond just a shopping holiday; it’s become a cultural moment.

From fashion and beauty to technology and experiences, Gen Z shoppers are shaping trends and pushing retailers to meet them where they are: online, on mobile devices, and on social platforms.

49. Up to 18% of Gen Z believe the best deals come before Black Friday.

(We are Pion)

Between 15% and 18% believe the real bargains drop earlier, before Black Friday even kicks off. This mindset reflects the growing trend of early deal launches, with retailers rolling out discounts days or even weeks ahead to capture attention.

For Gen Z, who thrive on immediacy and staying ahead of the curve, it makes sense. Why wait in line (or online) when the savings start early?

50. 44% of consumers say retailers sent too many Black Friday emails.

While email remains one of the strongest drivers of sales, shoppers are showing signs of fatigue.

Too many messages risk turning excitement into annoyance, pushing people to hit “unsubscribe” instead of “shop now.” The challenge for retailers is to stand out with smarter targeting and more value, rather than just increased volume.

51. 58% of U.S. Black Friday shoppers say Amazon is the best place for deals.

The mix of massive inventory, fast delivery, and aggressive discounts makes Amazon hard to beat.

This dominance also shows why competing retailers fight so hard to stand out, because for most shoppers, Black Friday starts (and often ends) with Amazon.

52. 36% of shoppers say they use Black Friday to treat themselves.

(Chain Store Age)

It’s a reminder that the sales frenzy isn’t only about holiday generosity.

Shoppers also see it as the perfect excuse to splurge on items they’ve been eyeing all year, whether it’s a new gadget, a fresh wardrobe piece, or a little luxury. Black Friday isn’t just gift-giving season, it’s self-gifting season, too.

53. 51% of Americans feel less pressure to shop on Black Friday thanks to longer sales windows.

(Freshworks)

With deals now stretching days, even weeks, beyond the traditional 24-hour rush, more than half of Americans say the pressure to shop on Black Friday itself has eased.

The extended timeframe gives shoppers breathing room to plan purchases instead of scrambling in one chaotic day.

54. 59% of consumers were dissatisfied with Black Friday shopping, blaming weak discounts.

(Sender)

Despite record-breaking sales, not everyone walked away happy. This dissatisfaction reveals a growing gap between shopper expectations and retailer strategies.

People come looking for once-a-year bargains, but when the markdowns feel ordinary, frustration sets in. It’s a reminder that hype alone can’t carry Black Friday, real savings still matter.

55. 57% of consumers want discount details before Black Friday arrives.

(Demand Sage)

This reflects a shift in how people approach Black Friday, from impulse to planning.

Advance visibility helps shoppers budget, compare options, and prioritize must-have items. For retailers, it’s a signal that secrecy doesn’t always build hype. Transparency can build trust and, ultimately, lead to bigger sales.

56. Over a third of consumers want discount information as early as possible.

(Demand Sage)

This urgency shows how competitive the holiday shopping season has become.

Early access to information means buyers can budget, compare, and even start checking off their lists before the rush. The earlier retailers share their deals, the better their chances of locking in those eager shoppers.

57. 21.2% of consumers want discount details a month in advance.

(Demand Sage)

For a sizable share of shoppers, even early isn’t early enough.

This trend highlights the growing importance of strategic holiday shopping. Instead of impulse-buying, many consumers now map out their purchases weeks in advance, waiting for the right moment to strike.

For retailers, releasing deals earlier could mean capturing wallets long before the competition even starts advertising.

58. 42% of shoppers prefer apps over mobile websites, even for filtering products.

(Sender)

The preference shows how expectations have shifted. Shoppers want seamless, personalized, and fast experiences, and apps deliver that better than clunky mobile browsers.

For retailers, this is a clear indication that investing in a polished app is essential. It’s what wins loyalty (and sales) during the holiday rush.

59. Black Friday weekend SMS marketing surged 34% as brands pushed real-time offers.

(Dot Digital)

Text messages were flying fast over Black Friday weekend. The spike shows how SMS has become a go-to tool for urgency-driven marketing.

Unlike crowded inboxes or social feeds, texts cut through the noise instantly, making them perfect for flash sales and limited-time deals. For many shoppers, the best bargains of the weekend likely came buzzing right into their phones.

60. SMS message volume rose 14.8% in the week before Black Friday.

(Dot Digital)

Retailers didn’t wait until Black Friday to start texting. This shows how the sales calendar keeps creeping forward.

Shoppers aren’t just being bombarded on the big day. The buildup itself has become part of the strategy, with texts setting the stage for the weekend frenzy.

61. Black Friday emails saw a 44% higher open rate and a 23% boost in clicks.

(Sender)

Email inboxes might be crowded during Black Friday, but shoppers are clearly paying attention.

The numbers prove that, despite complaints of overload, email remains one of the most effective tools for driving Black Friday sales. When the subject line promises real savings, shoppers are more than willing to click and buy.

62. 42% of online shoppers find Black Friday deals through social media ads and influencers.

(Scandiweb)

This stat shows how platforms like Instagram, TikTok, and Facebook have become shopping gateways.

Slick ad targeting and influencer recommendations now rival email blasts and store flyers in shaping where shoppers click “buy.”

63. Social media drives just 5% of total Black Friday and Cyber Monday sales.

(Sender)

Despite its influence on discovery, social media’s direct impact on sales remains small.

Shoppers may discover products through social media feeds, but most still complete purchases on brand websites, apps, or marketplaces. Social media shapes the hype, but it hasn’t yet cracked the code to dominate sales.

64. Small businesses saw sales climb 20% during Black Friday weekend.

(Sender)

It wasn’t just the retail giants cashing in, small businesses had a big weekend too. This lift highlights how Black Friday has evolved into an opportunity for businesses of all sizes.

With the right mix of deals, niche products, and loyal customers, small retailers are carving out their share of the holiday shopping frenzy.

65. 61% of U.S. consumers believe Black Friday deals are better online than in stores.

(Criteo)

This reflects a shift in mindset as shoppers trust that the deepest discounts, fastest comparisons, and widest selection are just a click away.

While in-store shopping still has its appeal, the belief that online wins on value keeps pushing more traffic (and dollars) toward digital checkout.

66. 74% of consumers search online for the best Black Friday deals.

(Criteo)

It’s proof that the deal hunt has gone digital. Instead of flipping through flyers or waiting for store windows, shoppers are comparing prices, checking reviews, and scanning promotions from their phones and laptops.

67. Over a third of Dutch consumers think Black Friday should be abolished.

(Statista)

The backlash is tied to growing concerns about overconsumption, waste, and the pressure to buy things people don’t actually need.

While retailers push for bigger sales, a vocal segment of Dutch shoppers views Black Friday as a symbol of unsustainable consumer culture, and they’re not shy about wanting it gone.

68. “Green Friday” is gaining traction among Dutch consumers as an alternative to Black Friday.

(Statista)

Green Friday, an anti-Black Friday initiative, is gaining momentum as consumers seek more sustainable alternatives to the shopping frenzy.

The movement encourages people to buy less, recycle, or support eco-friendly brands instead of splurging on discounts. Its rise highlights the cultural divide around Black Friday: for some, it’s about bargains, but for others, it’s about taking a stand against overconsumption.

69. Up to 40% of Dutch consumers see Black Friday as outdated.

(IG&H)

This sentiment reflects a cultural shift, while younger shoppers may still chase deals, a significant share of the population is questioning whether Black Friday has outlived its relevance.

Between sustainability concerns and fatigue over endless promotions, many Dutch consumers are ready to move on from the frenzy.

70. 37% of Dutch consumers think retailers should close during Black Friday.

(Statista)

It’s a reflection of how deeply the skepticism runs. For many Dutch shoppers, the event is disruptive and unnecessary.

Calls for closures tie into the broader movement toward sustainability and conscious consumption, showing how differently Black Friday is viewed across cultures.

71. Over half of U.K. shoppers use Black Friday to get a head start on Christmas gifts.

(Statista)

This shows how the holiday has become less about impulse splurges and more about practical planning.

For many households, Black Friday is the perfect opportunity to stretch their budgets further while securing presents before December’s rush. It’s the unofficial kickoff to holiday gift-buying.

Final Thoughts on Black Friday shopping statistics

Black Friday has grown far beyond a single shopping day. From record-breaking sales to the rise of mobile checkout, AI-driven shopping, and shifting consumer attitudes, the numbers tell a clear story: the event is evolving, fast.

For some, it’s about scoring once-a-year bargains or getting a head start on Christmas gifts. For others, especially in places like the Netherlands, it’s a symbol of overconsumption that needs to change.

What’s undeniable, though, is its global reach. Billions are spent, millions of orders are placed, and retailers, both big and small, fight to capture attention.

The statistics prove that Black Friday is no longer just about discounts, it’s about strategy, culture, and the future of shopping itself.

Sources:

Check out my other Statistics round up: