Fintech isn’t the future anymore, it’s the present. In just a few years, how we bank, borrow, invest, pay, and manage money has changed.

But how big is fintech? And where is it headed next?

After digging deep into the numbers, it is clear that fintech is growing faster, moving bigger money, and reshaping financial services in ways most people don’t even realize.

In this post, I’ll examine powerful fintech statistics that reveal what’s happening behind the scenes, the trends, the challenges, and the massive opportunities.

Whether you’re building, investing, or just curious about where money is moving, these stats tell a story you can’t afford to miss. These stats are all from verified and reputable sources and you will find a complete list at the bottom of this article.

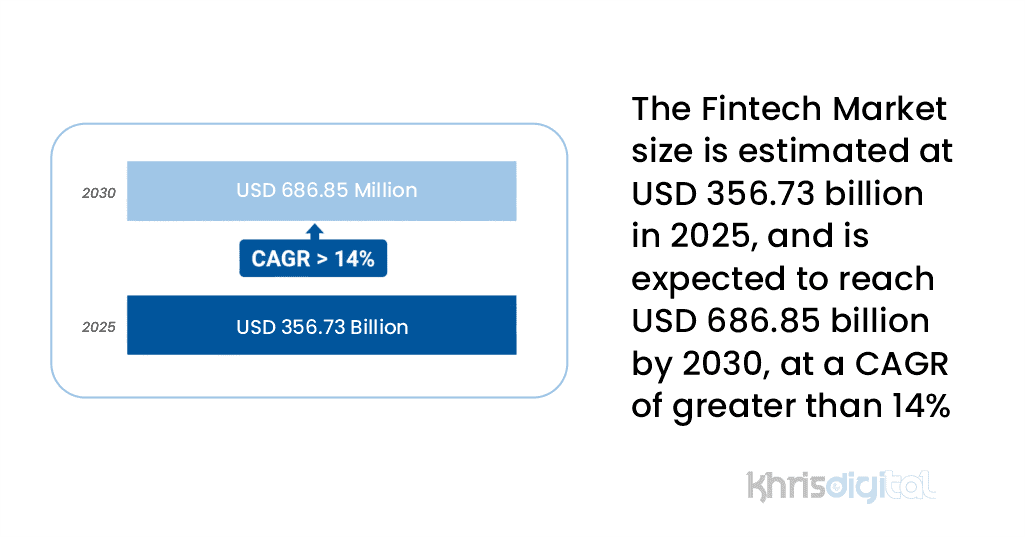

1. The Fintech Market size is estimated at USD 356.73 billion in 2025 and is expected to reach USD 686.85 billion by 2030, at a CAGR greater than 14% during the forecast period.

(Mordor Intelligence)

What’s driving it? Innovation, plain and simple. From mobile payments and robo-advisors to blockchain tech and buy-now-pay-later apps, fintech is reshaping how people interact with money globally.

Whether you’re building, investing, or partnering, the wave is gaining speed, and those who ride it early stand to benefit the most.

2. Global investments in fintech are valued at $95.6 billion.

(KPMG)

From venture capitalists backing the next big payments app to private equity firms funding blockchain startups, money is flooding into the space at every level.

It’s about reimagining everything from lending and insurance to wealth management and cross-border payments.

This level of investment also means competition is fierce. New ideas pop up daily. But it also means innovation is happening faster than ever, and consumers are reaping the benefits with smarter, faster, and more accessible financial tools.

3. Visa is the largest fintech company worldwide, with a market cap of $696.6 billion, followed by Mastercard, which has a market cap of $521.8 billion.

(Statista)

These two aren’t just credit card companies. They’re massive payment ecosystems that have quietly powered global commerce for decades.

This reminds us that legacy players can still dominate in a fast-changing industry if they keep evolving.

Visa and Mastercard have invested heavily in digital wallets, contactless payments, and cybersecurity, keeping them ahead of fintech upstarts trying to disrupt the space.

4. North America holds the largest share of the global fintech market at 34.05%, with $112.91 billion.

(Fortune Business Insights)

Established financial infrastructure, a deep pool of tech innovation, aggressive venture capital, and a population quick to adopt digital banking, mobile payments, and investment apps is fueling this.

Major fintech hubs like New York, San Francisco, and Toronto continue to crank out some of the most disruptive startups on the planet. This statistic indicates that while fintech is global, the U.S. and Canada still set the pace for much of the world.

5. The United States holds the highest share of fintech investment deals worldwide accounting for 45.6% of global FinTech investment.

(Innovate Finance)

The U.S. has the perfect conditions for fintech to thrive with a mature financial system ready for disruption, a deep well of venture capital, a risk-taking entrepreneurial culture, and tech hubs like Silicon Valley, New York, and Austin driving nonstop innovation.

From mobile payment startups to blockchain solutions to digital lending platforms, the U.S. fintech scene touches every corner of finance and investors are betting billions that the next big thing is already being built there.

6. Asia Pacific is expected to surpass the U.S. and become the largest fintech market by 2030, driven by mobile-first economies.

(The Economic Times)

Countries like China, India, Indonesia, and Vietnam are leapfrogging traditional banking systems and diving straight into mobile payments, digital wallets, and app-based financial services.

In places where smartphones are more common than bank accounts, fintech isn’t just a convenience, it’s a necessity.

Massive, young populations, combined with high mobile adoption rates, are creating the perfect storm for explosive fintech growth across Asia Pacific.

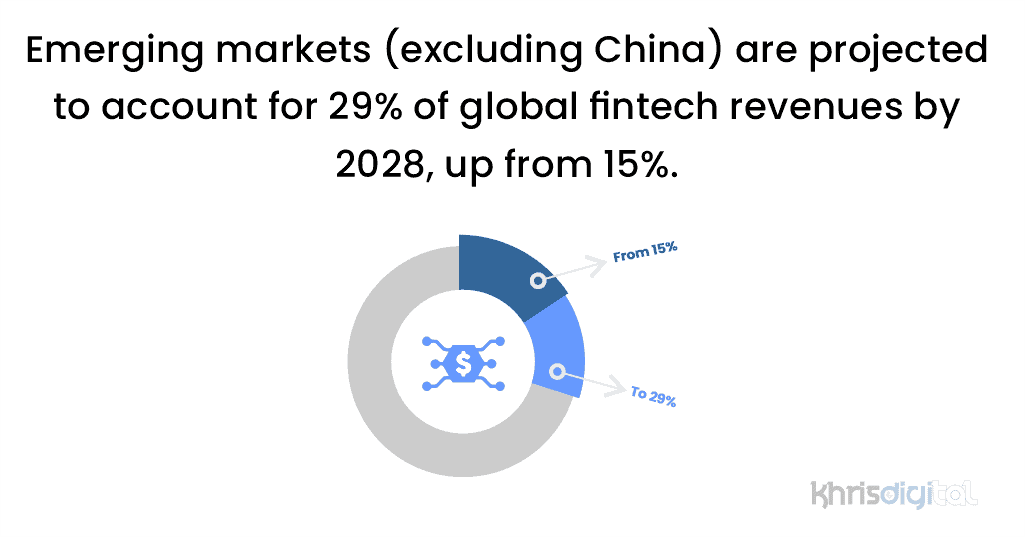

7. Emerging markets (excluding China) are projected to account for 29% of global fintech revenues by 2028, up from 15%.

(DocuClipper)

The fintech story isn’t just happening in Silicon Valley or Shanghai anymore.

What’s driving this surge is rapid smartphone adoption, increasing internet access, a growing middle class, and, most importantly, millions of people entering formal financial systems for the first time through digital platforms.

In regions across Africa, Latin America, Southeast Asia, and South Asia, fintech is building finance from scratch. Emerging markets are stepping into the spotlight, and the opportunity is massive for those paying attention.

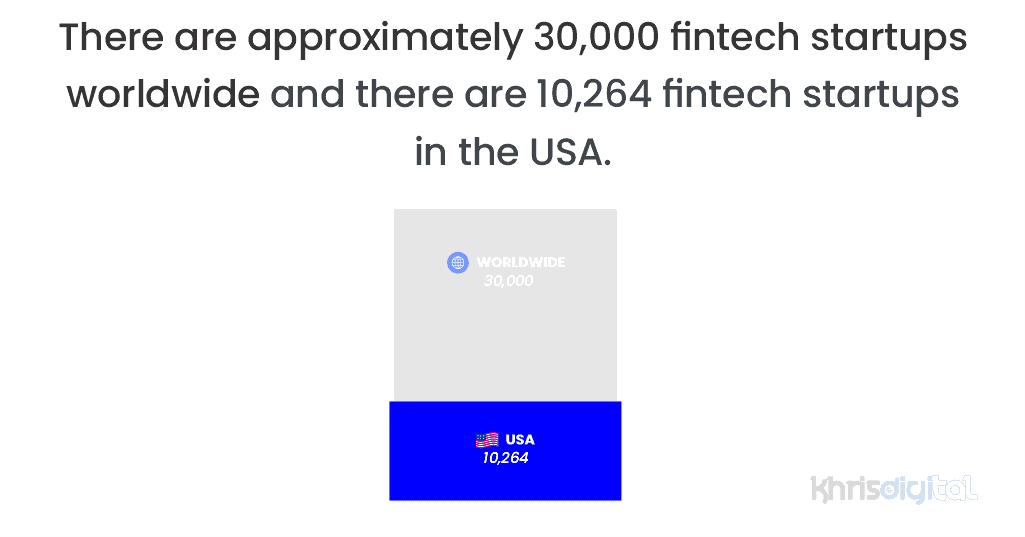

8. There are approximately 30,000 fintech startups worldwide.

(Blue Tree Digital)

From tiny bootstrapped teams building the next payment app to well-funded companies tackling cross-border finance, the diversity of ideas is staggering. These agile innovators are challenging and rebuilding every aspect of traditional banking and finance.

Competition is fierce with this many players in the game. Standing out takes more than just a clever idea. It takes execution, trust, scalability, and the ability to navigate a complex, heavily regulated industry.

9. The United States is home to 10,264 fintech startups.

(Statista)

Out of the 30,000 fintech startups worldwide, a massive chunk call the United States home. That’s about a third of all fintech innovation happening inside U.S. borders.

Fintech ideas are bubbling up everywhere, from bustling hubs like San Francisco, New York, and Austin to emerging hotspots across the Midwest and South.

Mobile banking, digital wallets, blockchain platforms, and robo-advisors startups are tackling every financial niche you can imagine.

10. Global fintech industry revenue has nearly doubled since 2017.

(Deloitte)

In just a few short years, global fintech revenue has almost doubled which is a clear sign that this isn’t just a hot trend; it’s a full-blown financial revolution.

From peer-to-peer payment apps to digital wealth management platforms to alternative lending models, fintech companies are taking huge bites out of traditional banking’s pie.

11. The number of fintech startups has more than doubled since 2019.

(BCG)

A global demand for faster, more innovative financial services, the rise of mobile-first economies, and a new wave of investors pouring billions into disruptive ideas is driving this boom.

Plus, the pandemic accelerated digital adoption, forcing consumers and businesses to rethink how they handle money.

12. Chime is the most popular neobank in the United States.

(Statista)

Regarding neobanks (digital-first banks with no physical branches), Chime leads the pack in the United States. Chime’s rise isn’t an accident. It nailed what customers want which is no hidden fees, user-friendly apps, early direct deposits, and budgeting tools that make sense.

Millions of Americans are perfectly comfortable managing their financial lives through an app, with no brick-and-mortar branch.

13. Digital payments lead the fintech sector with the highest number of users.

Digital wallets, peer-to-peer payment apps, and contactless checkout have all become a normal part of everyday life.

Whether it’s paying for coffee with your phone, splitting a dinner bill through an app, or sending money across borders instantly, digital payments have made financial transactions faster, easier, and way more convenient.

14. The Nasdaq stock exchange currently lists 463 fintech stocks, hosting many of the world’s largest technology companies.

(Siege Media)

When it comes to tech and finance, Nasdaq is the ultimate stage. Home to giants like Apple, Amazon, and Google, Nasdaq also boasts a robust lineup of 463 fintech stocks.

From payment processors to digital lenders to blockchain innovators, fintech companies are making major public market claims. Being listed on Nasdaq gives these firms visibility, credibility, and access to serious investor capital, fueling even faster growth and innovation.

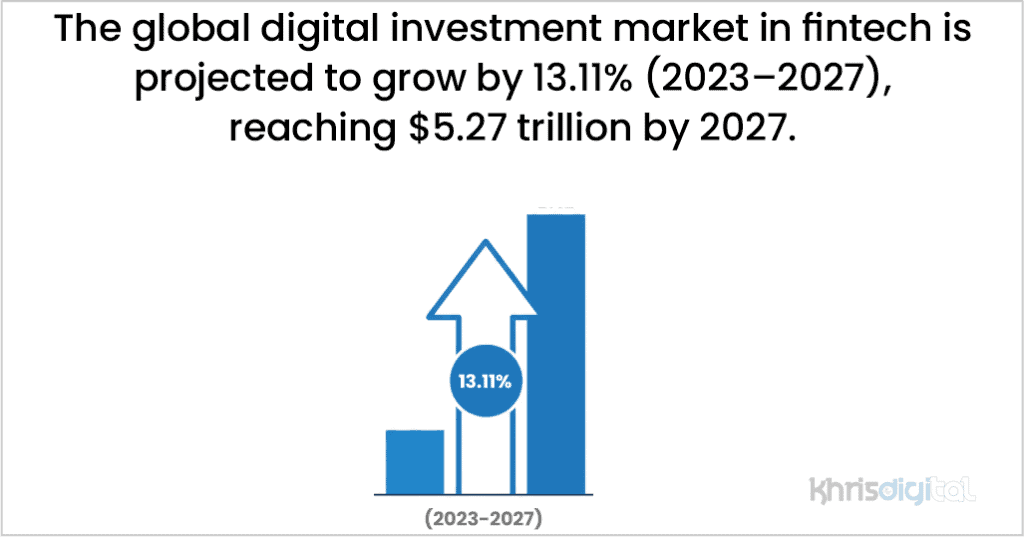

15. The global digital investment market in fintech is projected to grow by 13.11% (2023–2027), reaching $5.27 trillion by 2027.

(Blue Tree Digital)

Easy-to-use platforms, low-fee robo-advisors, fractional shares, and a new generation of investors who expect to manage wealth from the palm of their hand without needing a traditional financial advisor are driving this surge.

Digital investment tools are breaking down old barriers to entry, making it possible for more people worldwide to start building wealth.

16. The global insurtech market is projected to grow at a CAGR of 48.8% from 2021 to 2028.

(Blue Tree Digital)

This growth is being fueled by startups and tech-driven companies using AI, big data, machine learning, and mobile-first experiences to reimagine insurance from the ground up.

Faster quotes, more personalized policies, automated claims — everything the traditional insurance industry has been slow to fix, insurtech is racing to improve.

Companies that blend technology with customer-first thinking will win and reshape an industry that touches nearly every person and business on the planet.

17. The global blockchain in fintech market is expected to grow at a CAGR of 43.4% from 2021 to 2028.

(Blue Tree Digital)

Faster cross-border payments, automated smart contracts, ultra-secure identity verification, and real-time transaction settlement are all made possible without multiple middlemen.

Blockchain is a natural fit as fintech companies push for more speed, transparency, and security. Banks, payment processors, and investment platforms are racing to figure out how to integrate blockchain before they get left behind.

18. The global robo-advisory market is expected to grow at a CAGR of 19.2% from 2021 to 2028.

(Blue Tree Digital)

Robo-advisors offer algorithm-driven financial planning and investment management with little human supervision. With low fees, minimums, and 24/7 access, robo-advisors democratize wealth management in a way traditional advisors never could.

The pandemic accelerated trust in digital tools, and now, more investors, especially millennials and Gen Z, are comfortable letting smart algorithms manage their portfolios.

19. The global peer-to-peer lending market is expected to grow at a CAGR of 29.7% from 2021 to 2028.

(Blue Tree Digital)

P2P lending platforms connect borrowers directly with individual investors, cutting out the banks entirely. Lower fees for borrowers and faster, simpler, and often more accessible financing options.

The model especially shines in underserved markets where traditional credit systems fall short, offering a new financial lifeline to small businesses and consumers alike.

20. The global wealthtech market is expected to grow at a CAGR of 25.8% from 2021 to 2028.

(Blue Tree Digital)

Wealthtech blends technology with investment and financial planning services, making robo-advisors, micro-investing apps, digital retirement accounts, and portfolio management tools more accessible than ever.

It’s about empowering everyday investors with the same tools Wall Street pros have used for decades, but now from a smartphone.

Driven by a new generation of investors who expect everything to be digital, transparent, and easy to use, wealthtech is carving out a massive future.

21. The fintech blockchain market is projected to grow from $2.1 billion in 2023 to $49.2 billion by 2030, with a CAGR of 56.4%.

(Business Wire)

Blockchain is increasingly being woven into payments, lending, insurance, and investment platforms.

It’s making financial transactions faster, more secure, and more transparent and cutting out much of the traditional friction (and middlemen) that slowed finance down for decades.

Blockchain isn’t just about crypto anymore. It’s becoming a core infrastructure technology for the future of finance, and the fintech companies that figure out how to leverage it best will own a massive piece of tomorrow’s financial ecosystem.

22. The AI in fintech market was valued at $12.2 billion in 2023 and is projected to skyrocket to $61.6 billion by 2032, growing at a 19.72% CAGR.

(SNS Insider)

AI is being woven into fraud detection, customer service chatbots, risk assessment, personalized banking, credit scoring, and even algorithmic trading.

Fintech companies that leverage AI can make smarter decisions faster, automate tedious processes, and offer hyper-personalized experiences to customers.

This stat shows that AI is a present competitive advantage. Companies that are slow to integrate AI into their financial products and services risk falling behind as smarter, faster, and more responsive fintechs take the lead.

23. The embedded finance market is projected to grow from $112.6 billion in 2024 to $237.4 billion by 2029.

(Globe News Wire)

Embedded finance occurs when non-financial companies (like rideshare apps, marketplaces, or retailers) integrate financial services like payments, lending, or insurance directly into their platforms.

Instead of sending customers elsewhere, they handle everything in one seamless experience.

Think about paying for a ride inside the Uber app or getting instant financing from an online store at checkout. There are no banks, no extra steps, just smooth, integrated financial transactions.

24. Instant payments are projected to grow from $22 trillion in 2024 to $58 trillion by 2028.

(Juniper Research)

People and businesses now expect faster payments. Whether splitting a bill, settling an invoice, or transferring salaries, waiting days for transactions to clear is becoming unacceptable in a hyper-digital world.

Fintech platforms, banks, and governments are racing to build real-time payment infrastructure to meet this rising demand. Instant payments cut costs, improve cash flow, reduce fraud, and create a smoother experience for everyone involved.

25. Open banking payments are forecast to grow from $57 billion in 2023 to $330 billion by 2027.

(Juniper Research)

Open banking allows consumers to securely share their financial data with third-party providers, unlocking faster payments, innovative budgeting tools, and a more personalized financial experience.

There are no middlemen, no unnecessary delays, just direct, permission-based connections between banks, apps, and services.

26. API calls in fintech are expected to rise from 137 billion in 2025 to 722 billion by 2029, that is a growth rate of 427%.

(Statista)

APIs (Application Programming Interfaces) are bridges that allow different software systems, such as banks, apps, and payment processors, to communicate in real time.

You can transfer money between apps, verify identities instantly, or access your account across platforms without missing a beat.

This staggering growth in API traffic shows how deeply interconnected financial systems are becoming and how important seamless, secure, and scalable infrastructure is for the future of finance.

27. Half of the world’s top 20 fintech companies by market cap are based in the United States.

When it comes to fintech dominance, the United States still holds the crown.

From giants like Visa and Mastercard to rising stars in digital payments, lending, and financial services, U.S. companies have built a massive lead by combining tech innovation with strong financial ecosystems.

With access to deep venture capital pools, tech-savvy talent, and a vast domestic market, American fintechs have scaled faster and farther than many of their global peers.

28. 48% of financial institutions have fully embedded fintech into their strategic operating models.

(PwC)

This shift is about rethinking how financial services are delivered, managed, and scaled. Traditional banks and financial companies realize they can’t survive with legacy systems and slow processes, while fintech startups are redefining speed, convenience, and personalization.

Embedding fintech means integrating digital payments, AI-driven lending, mobile banking apps, real-time analytics, blockchain solutions, and more into everyday operations.

29. 40% of financial services companies believe blockchain will transform how financial services are delivered.

And they’re not wrong. Blockchain promises faster transactions, better transparency, reduced fraud, and lower costs without the need for traditional intermediaries.

From smart contracts to decentralized finance (DeFi) platforms, the potential applications stretch across payments, lending, insurance, investing, and beyond.

This stat shows that blockchain is viewed as an evolution. Financial firms that embrace blockchain now will be better positioned to deliver faster, cheaper, and more trusted services to a digital-first generation of customers.

30. 75% of financial institutions are hiring staff and creating jobs focused on fintech.

(Siege Media)

These aren’t just traditional banking jobs with a tech twist. We’re talking about demand for data scientists, blockchain developers, AI specialists, cybersecurity experts, and UX designers.

These are people who can build, scale, and protect the digital financial ecosystems customers expect today.

Banks and financial firms know that if they don’t build modern teams with deep digital expertise, they’ll quickly fall behind more agile competitors.

31. Over 12,000 fintech startups worldwide are using AI in their operations.

(Blue Tree Digital)

From smarter credit scoring and fraud detection to personalized investment advice and automated customer service, AI is the secret sauce behind some of the most innovative FinTech products.

It helps companies move faster, make better decisions, and deliver ultra-personalized experiences at scale, something traditional finance simply can’t match manually. In the race for better, faster, and more human-like digital finance, AI is propelling fintech forward.

32. Around 90% of global fintech companies heavily rely on artificial intelligence and machine learning.

(University of Cambridge)

AI powers everything from real-time fraud detection and dynamic credit scoring to hyper-personalized banking experiences and smart trading algorithms. Machine learning models continually adapt and improve, making fintech platforms sharper, faster, and more accurate.

AI is the technology that’s redefining risk management, customer service, personalization, compliance, and efficiency, and the companies mastering it are setting themselves up to dominate the future of finance.

33. Over 71% of financial institutions now use AI to combat fraud.

(PYMNTS)

Traditional fraud detection systems relied on rigid rules that couldn’t keep up with evolving threats. Conversely, AI can spot unusual patterns, predict suspicious behavior, and respond in real time at a scale that manual systems can’t match.

Whether stopping a fraudulent transaction mid-swipe or detecting identity theft attempts before they succeed, AI is giving banks and fintechs a serious upgrade in their defense systems.

34. AI-powered fraud detection systems are estimated to cut investigation time by 70% and boost accuracy by 90%.

(The Business Research Company)

Fighting fraud is about seeing them fast and accurately. AI and machine learning are delivering exactly that.

That’s game-changing. Traditional fraud detection often involved slow, manual reviews with plenty of false positives (flagging legit transactions) and missed threats.

AI flips that model. It instantly analyzes massive amounts of transaction data, identifies unusual behavior, and flags real threats in real-time. For financial institutions and fintechs, this means faster response times, fewer false alarms, happier customers, and serious cost savings.

35. 94% of financial services executives believe fintech will enhance customer experience and drive future revenue growth.

(PwC)

Today’s consumers expect more: faster service, personalized products, frictionless transactions, and 24/7 access.

Traditional finance models, built around paperwork and waiting rooms, can’t deliver that. Fintech can, and it’s already raising the bar across payments, lending, investing, and banking.

The companies that embrace fintech-driven innovation will thrive, while the laggards will lose both customers and market share.

36. Over 25% of financial services companies believe FinTech’s ease of use and speed will improve customer retention.

(PwC)

It makes total sense. Long hold times, clunky interfaces, endless forms — that’s the old way. Today’s users expect seamless onboarding, instant approvals, real-time updates, and mobile-first experiences. If you make it hard, they’re gone.

37. 56% of unbanked individuals say they are not interested in opening a checking or savings account in the future.

(FDIC)

Financial institutions have long viewed the “unbanked” as a group just waiting to be served but reality paints a different picture.

Why the resistance? Some cite distrust of banks, others feel fees and requirements are too burdensome, and many don’t see traditional banking as relevant to their daily lives. For them, cash, prepaid cards, or newer fintech solutions feel easier, faster, and more accessible.

Reaching the unbanked is about rethinking the entire financial experience. Fintech companies that can build trust, offer convenient services, and remove barriers have a real chance to reach this overlooked but massive market.

38. Individuals who rely only on cash lose an average of $198.83 per year to check cashing and money order fees.

(NerdWallet)

It adds up fast. Without access to traditional banking, people often have to pay hefty fees to access their own money. For many low-income earners, nearly $200 a year represents a severe financial burden.

Fintech solutions that offer low-cost, easy-to-access banking alternatives (like mobile wallets, digital banking apps, and prepaid cards with minimal fees) have the potential to make a huge impact on millions of people.

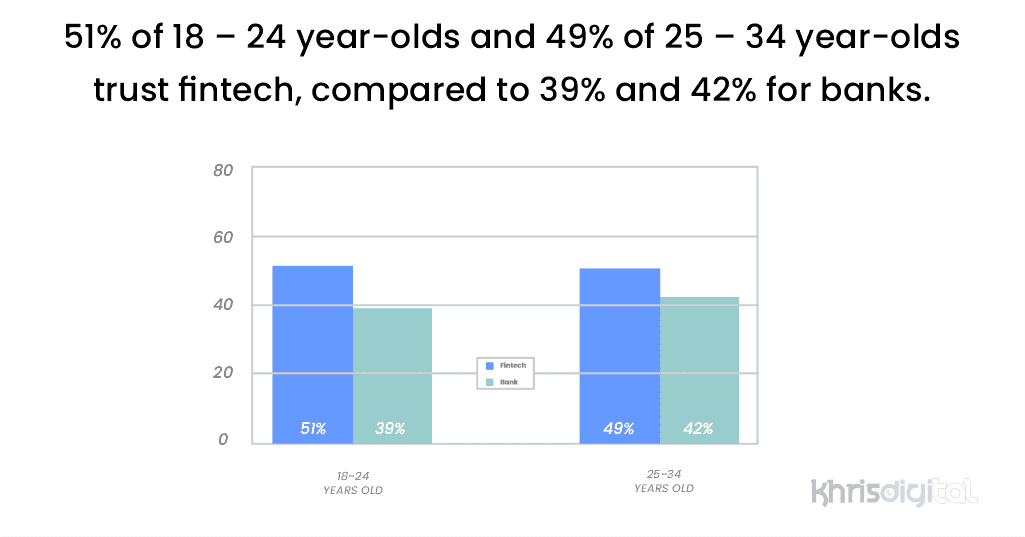

39. Young people trust fintech companies more than banks. 51% of 18 – 24 year-olds and 49% of 25 – 34 year-olds trust fintech, compared to 39% and 42% for banks.

(Statista)

That’s a massive shift. Younger consumers grew up in a digital-first world, where apps, instant access, and personalized experiences are the norm.

They expect speed, transparency, and control, and many feel that banks are still stuck in an outdated model that doesn’t prioritize the customer.

This stat is a warning to traditional finance that the loyalty banks once relied on is eroding fast. Fintechs that continue to innovate around user experience, low fees, and mobile-first services are winning the hearts and wallets of the next generation.

40. 58% of people are visiting bank branches less, while 61% are using mobile banking apps more frequently.

(S&P Global)

The way people interact with their money is changing fast and it’s becoming almost entirely digital.

Customers want the ability to check balances, transfer money, pay bills, and even apply for loans without ever stepping inside a bank. And they want it to be easy, secure, and available 24/7.

41. Most Gen Z and Gen Y use mobile banking, with 51% of Gen Z and 64% of Gen Y checking balances and activity through apps.

(Morgan Stanley)

Banking apps have replaced paper statements, teller visits, and desktop logins for these groups. They want real-time updates, simple interfaces, and the ability to manage their money on the go from their smartphones.

This stat is a loud reminder that banks and fintech must prioritize mobile-first experiences if they want to stay relevant with younger customers.

42. 55% of U.S. bank customers prefer mobile apps for banking, while only 22% favor online banking via computers.

Mobile apps offer what today’s customers crave: instant access, real-time updates, and the ability to manage money anytime, anywhere. Opening a laptop and logging into a clunky online portal doesn’t compete with the speed and simplicity of a well-designed app.

In the years ahead, financial institutions that focus on delivering fast, intuitive, and secure mobile experiences will be the ones that capture (and keep) customer loyalty.

43. Around 39% of consumers shop from their mobile devices daily or weekly, and 23% shop from their phones every day.

(Global Payments)

This stat shows why mobile-first commerce and embedded finance are exploding. People are already spending money from their phones and they expect payment processes to be fast, seamless, and secure.

Fintech solutions that integrate one-click checkouts, digital wallets, and instant financing options are meeting customers exactly where they are, in the palm of their hand.

44. The most popular apps for paying bills and sending or receiving money are PayPal (59%), banking apps (41%), and Google Wallet (20%).

(S&P Global)

PayPal’s longevity and ease of use make it a trusted favorite for both personal transactions and online purchases. Banking apps provide a direct, secure link to individual accounts, and Google Wallet’s tight integration with Android devices makes it a go-to for many mobile users.

Consumers no longer think twice about paying bills, sending money to friends, or buying goods directly from their smartphones.

For fintech and businesses alike, the message is clear: if you want to win in digital finance, your solution has to be mobile-first, trusted, and easy to use—because convenience wins every time.

45. 90% of Chinese citizens use fintech solutions for banking, payments, and financial management.

(Exploding Topics)

Apps like Alipay, WeChat Pay, and other digital platforms have made financial services seamless, instant, and mobile-first. People can pay bills, transfer money, invest, and even get loans from their smartphones without ever needing to visit a physical bank.

This level of adoption shows what happens when fintech innovation meets massive scale and cultural readiness for digital living.

It also sets a powerful example for the rest of the world: when financial technology is easy, trusted, and deeply integrated into daily life, mass adoption is inevitable.

46. U.S. personal loan agreements made through fintech platforms have increased by 33%.

(Exploding Topics)

Getting a loan used to mean paperwork, waiting, and often frustration. Not anymore. Fintech lenders offer faster applications, instant decisions, competitive rates, and a completely digital experience, things that traditional banks have struggled to match.

It’s a no-brainer for borrowers, because why wait days (or weeks) for an answer when a fintech app can deliver approval within minutes?

47. Most senior banking executives believe fintech is having a significant impact on wallets and mobile payments.

(Capgemini)

Mobile wallets like Apple Pay, Google Pay, and countless fintech apps have shifted payment behavior from cards and cash to smartphones and smartwatches.

Speed, security, and convenience are driving this shift, and fintech companies are leading the charge by delivering faster, easier, and more secure payment experiences.

48. In 2024, 49% of U.S. smartphone users used proximity mobile payments, and the global P2P payments market was valued at over $2.6 trillion.

(DocuClipper)

This double surge shows that digital money movement is now the norm, not the exception. Whether paying for groceries, splitting a restaurant bill, or sending cash to a friend, mobile-first, peer-to-peer transactions are faster, easier, and increasingly expected.

Companies making payments seamless with a simple tap, swipe, or click are winning customer loyalty and expanding their market share at breakneck speed.

The days of needing cash or even pulling out a card quickly fade. The future of payments is wireless, instant, and built into the devices we already carry.

49. In 2024, the U.S. ACH Network processed 33.6 billion payments totaling $86.2 trillion, while digital wallets gained significant ground in retail and e-commerce.

(DocuClipper)

ACH (Automated Clearing House) payments are the backbone of direct deposits, bill payments, and B2B transactions. And they’re growing alongside newer, faster fintech innovations like mobile wallets.

Meanwhile, consumers embrace Apple Pay, Google Pay, and similar apps at checkout counters and online shops.

50. Major players in online payments include Apple Pay, Google Pay, PayPal, Alipay, and WeChat Pay. Apple Pay handles nearly 10% of global card transactions, and WeChat Pay has over 800 million monthly active users.

When it comes to online and mobile payments, a few giants dominate the field. Apple Pay, Google Pay, PayPal, Alipay, and WeChat Pay are leading the way, and the numbers behind them are mind-blowing.

Apple Pay alone processes nearly 10% of all global card transactions, a staggering figure highlighting how deeply mobile wallets are embedded in everyday life.

51. In 2024, the average data breach cost hit $4.88 million, with 88% caused by human error and 41% of CISOs naming ransomware as a top concern.

These numbers are a flashing red warning for fintech dealing with sensitive financial data. No matter how advanced the technology, people remain the weakest link whether through phishing attacks, weak passwords, or simple mistakes.

And ransomware attacks, which lock critical systems and demand hefty payments, are growing more sophisticated by the day.

52. 93% of fintech professionals struggle with compliance, and over 60% of companies paid more than $250,000 in fines last year due to regulatory complexity.

(American Bankers Association)

Navigating financial regulations is notoriously tricky. Rules vary by country, change frequently, and cover everything from data privacy to anti-money laundering (AML) and customer identity verification (KYC).

This statistic is a stark reminder that compliance is a make-or-break factor in doing business in fintech.

53. While 37% of consumers trust fintech the most, traditional banks still hold strong loyalty, making lasting trust a significant challenge for fintech companies.

(Morning Consult)

This split shows the tightrope fintech is walking. They win with speed, convenience, and innovation, but trust in finance is hard-earned and easily lost.

Consumers still associate banks with safety, regulatory oversight, and long-standing reputations, even if their experiences aren’t always ideal.

For fintech companies, acquiring initial users is one thing, but retaining them over the long term requires robust security, transparency, and customer service. Those who combine innovation with deep, consistent trust will define the next era of financial services.

Final Thoughts on Fintech Statistics

Fintech is the engine driving the future of finance. From mobile payments to AI-powered fraud prevention, the fintech landscape is growing faster and becoming more sophisticated, forcing traditional financial services to catch up or risk being left behind.

But even with all the growth, the heart of fintech’s success comes down to trust and experience.

The companies that win will be those that truly understand what people need and deliver it better than anyone else. Whether starting a fintech company, partnering with one, or simply watching the space with interest, now’s the time to pay attention.

The next wave of financial innovation is already here and it’s just getting started.

Sources:

Check out my other Statistics round-up: